เครื่องติดตาม GPS DLT

เครื่องรูดบัตร GPS DLT เครื่องรูดบัตรใบขับขี่ มาตรฐานกรมขนส่ง ติดตามรถของคุณด้วยพิกัดที่แม่นยำโดยใช้ระบบ GPS แบบเรียลไทม์ ตัวติดตาม GPS 4G ได้รับการออกแบบให้ทำงานกับเครือข่ายเซลลูล่าร์ทั้งหมด

ระบบการจัดการแบตเตอรี่

โดยจะรวบรวมและส่งข้อมูล เช่น แรงดันแบตเตอรี่ กระแสไฟฟ้า อุณหภูมิ และสถานะการชาร์จ (SoC) โดยให้ข้อมูลแบบเรียลไทม์เพื่อเพิ่มประสิทธิภาพการทำงานของแบตเตอรี่ มั่นใจในความปลอดภัยของคุณ ยืดอายุแบตเตอรี่และแจ้งเตือนการชาร์จไฟเกินหรือการคายประจุจนหมด

เครื่องติดตาม GPS บลูทูธ

ใช้เทคโนโลยีบลูทูธเชื่อมต่อกับสมาร์ทโฟนและช่วยให้ผู้ใช้ติดตามตำแหน่งของรถสองล้อได้ในขอบเขตที่จำกัด ขนาดเล็กและน้ำหนักเบา ให้ความสะดวกสบายสำหรับการใช้งานส่วนตัว โดยอาศัยความสามารถ GPS ของอุปกรณ์ที่จับคู่สำหรับข้อมูลตำแหน่งและข้อมูลความปลอดภัย

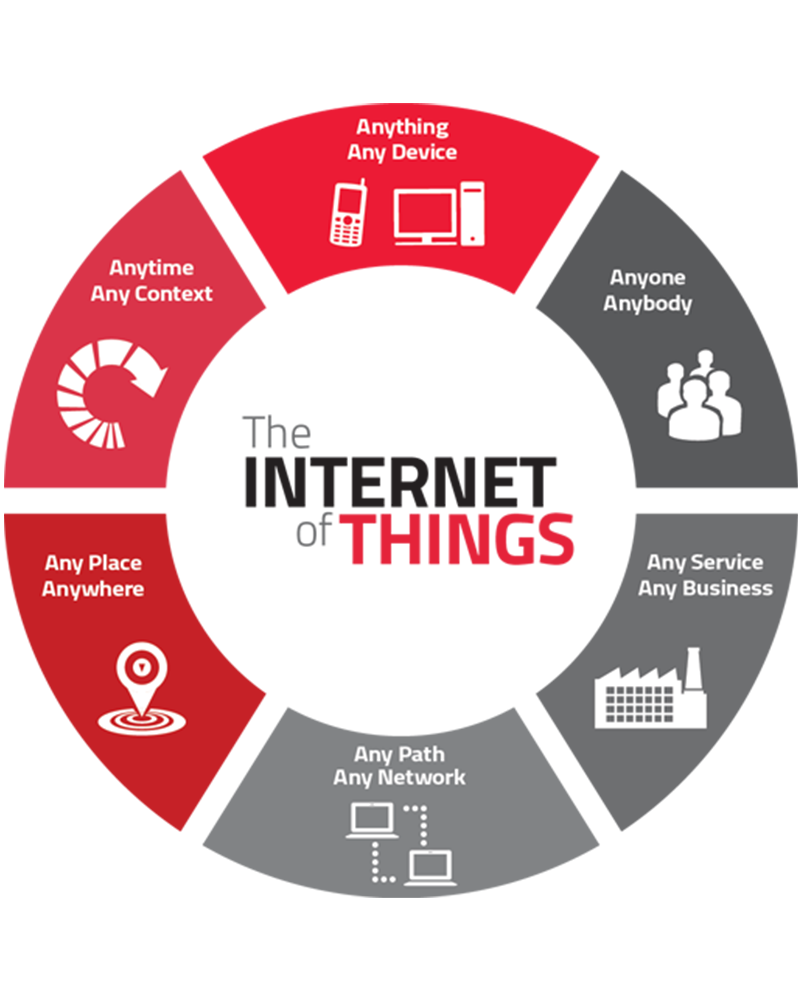

การเชื่อมต่อและการจัดการข้อมูล

Internet of Things (IoT) และเทเลเมติกส์เป็นเทคโนโลยีสำคัญที่ขับเคลื่อนอนาคตของการเชื่อมต่อและการจัดการข้อมูล เราผลิตอุปกรณ์ที่ผสมผสานโทรคมนาคมและเทคโนโลยียานพาหนะเพื่อตรวจสอบและจัดการข้อมูลยานพาหนะจากระยะไกล รวมถึงการติดตาม GPS การวินิจฉัยเครื่องยนต์ และการตรวจสอบแบตเตอรี่ EV Internet of Things ขยายความสามารถด้านเทเลเมติกส์โดยบูรณาการอุปกรณ์และเซ็นเซอร์ที่หลากหลาย ตัวอย่างเช่น ระบบเทเลเมติกส์ในรถยนต์สามารถใช้ Internet of Things เพื่อนำเสนอข้อมูลแบบเรียลไทม์ ข้อมูลแบบเรียลไทม์เกี่ยวกับข้อกำหนดในการบำรุงรักษาประสิทธิภาพของยานพาหนะและพฤติกรรมของผู้ขับขี่ การบูรณาการนี้ช่วยให้สามารถวิเคราะห์ข้อมูลที่ซับซ้อนมากขึ้น สามารถเพิ่มประสิทธิภาพการดำเนินงานและให้ข้อมูลเชิงลึกที่นำไปปฏิบัติได้สำหรับทั้งธุรกิจและผู้บริโภค

ด้วยประสบการณ์กว่า 14 ปีในอุตสาหกรรมระบบติดตามยานพาหนะ เราผลิตระบบติดตามยานพาหนะ GNSS, IRNSS, GPS เพื่อความปลอดภัยของยานพาหนะและการใช้งานอย่างมีประสิทธิภาพ เราอัพเกรดผลิตภัณฑ์ที่มีอยู่อย่างต่อเนื่องและเปิดตัวผลิตภัณฑ์ใหม่เพื่อตอบสนองความคาดหวังของลูกค้าของเรา เทอร์มินัลข้อมูล BMS IoT ของเราเชื่อมต่อกับแบตเตอรี่รถยนต์ไฟฟ้าโดยใช้ CAN, 485 เพื่อให้การวิเคราะห์แบบเรียลไทม์ของวงจรการชาร์จและการคายประจุของเซลล์ไปยังแพลตฟอร์มคลาวด์

บริการที่มีให้

การออกแบบและพัฒนาฮาร์ดแวร์แบบฝังและแอปพลิเคชันที่ใช้ฮาร์ดแวร์ตั้งแต่เริ่มต้นไม่ใช่เรื่องเล็กๆ ให้ทีมงานฝังตัวที่มีประสบการณ์ของเราทำงานร่วมกับทีมของคุณเพื่อนำเสนอโซลูชันหรือการออกแบบผลิตภัณฑ์ที่สมบูรณ์ตามความต้องการของคุณ

โซลูชั่นที่สมบูรณ์แบบสำหรับธุรกิจที่กำลังมองหาพันธมิตรด้านการพัฒนาเพื่อคิดค้นและผลิตโซลูชั่นที่ปรับแต่งได้อย่างสมบูรณ์ ธุรกิจของคุณจะทำให้เรามีความต้องการงาน และวิศวกรของเราจะเริ่มทำงานกับคุณทันที

Address

10184, 4th Floor, Arya Samaj Road, Karol Bagh, New Delhi 110005 India

Phone

+91-7042392617

sales@m2cloud.in

Copyright © 2024M2Cloud LLP. All rights reserved.